I’m $100,000 richer today because of this

You can do it, too / sometimes sticking up for yourself is totally worth it

Thanks for reading, thanks for subscribing, and thanks for supporting The Museletter with your $7 contribution. You can also tip me at Venmo or PayPal if you don’t want to subscribe, (or comment, or share this post—every little interaction helps) but like what’s going on over here.

Etc.

I’m America’s first Comedy Laureate — unofficially | Substack

I had a great time opening Jena Friedman’s solo show at Union Hall on Sat | Insta

I literally got a man to admit to murder in my fun new song Secrets | Facebook

College was fun. I went to the Art Institute of Philadelphia, where I borrowed $18k to learn to be an animator.

I didn’t walk in the door with the dream of becoming an animator. I was hoping to study illustration and graphic design.

But the man in charge of enrolling me saw a sitting duck. Quack, quack. I was young, alone, desperate for direction and a change in my life, and excited by the opportunity the college offered me.

The graphic design program I wanted to enroll in cost less than the animation program. But the man showed me charts and graphs proving how much more animators earn than graphic designers. He said, “If you don’t like the program, you can always switch to graphic design later.” He might as well have offered me candy and puppies from his van. I fell for it hook, line, and sinker.

A few months into the program, I realized I was not happy. I did not want to be an animator. I went to the man and asked to change to graphic design, as he’d said I could. He seemed angry. He said, “If you change, you’ll have to start the whole program over. You’ll lose half the credits you already earned.” I was scared. I didn’t want to make him mad, and I didn’t want to start over. I had a sinking feeling in my stomach as I left his office that day that stayed with me for the rest of my time there.

It wasn’t all bad, I met Kurt Metzger, Big Jay, Stu Kamens, “Lil” Kevin Hart, Jamiroquai, The Samples, Jess Edge and Kitty Kowalski during my time there, and it was there I learned that I wanted to be a comedian.

After I graduated, I got a job animating, and then the business immediately folded. Then, I got another job as a Junior Art director and that company immediately folded. The bubble was bursting all over everything. I was a soft pushover, but no dummy. I could see the writing on the wall. It was around that time that the sinking feeling rose from a low level gurgle to a full on broil.

As I shuffled around, trying to make sense of how to use my degree, I decided I’d be much happier if I just threw myself into life as a professional comedian, and that’s what I did.

Over the years, the college loan bills began piling up. Work as a professional comedian meant feast or famine. I did my best to try to make loan payments, but I just wasn’t able to keep up. Interest started gaining on me, and before I knew it, I was in a situation where I was unable to make payments that even touched the interest anymore. And then I became worried, and then I started getting mad.

I was now stuck with a $50k loan for a degree I couldn’t use and never wanted. I felt taken advantage of, and that is, maybe, my least favorite sensation. But it’s an important emotion for me, because it always immediately puts me into action mode.

I called the Department of Education, and my loan manager, Navient, and made them an offer to pay the original $18k sum in one lump. They refused my offer.

Convinced there had to be a way to find some kind of relief, I launched myself on a determined quest for knowledge, and that’s when I learned about predatory lending.

Furthermore, I learned that the Art Institute was under investigation for a slew of dubious practices.

The deeper I went down the rabbit hole, the more I was certain, I shouldn’t have to pay these scammy loans.

Think about it. In NJ, there’s the lemon law if you buy a stinker of a car. Credit cards protect people from seedy salespeople. A store and even Amazon will take back defective clothing or food. Why shouldn’t a college have to adhere to the same expectations?

I tried to contact lawyers, but my complaints fell on deaf ears.

As usual, I was way ahead of the curve.

I tried a number of other maneuvers to be heard, but without much luck. I even improvised a song over the phone to one of my debt collectors.

Finally, I stumbled upon Borrower’s Defense—a statute that allows people who believe their school was engaged in illegal tactics to complain and have their case investigated. In 2017, while caring for an infant, I filed a complaint, and was denied. I was aghast, though not surprised. What were the chances they’d side with a person who owed them money? I resubmitted. COVID hit. I was expecting another baby. I waited. As the interest tsunami’d from $18k to $80k, I hung onto the hope that someday it would get resolved.

In 2022, I received an email from the Department of Education that my Borrower’s Defense application was included as a part of the Sweet v. Cardona class action lawsuit.

Here’s a blurb about the website from studentaid.gov:

“A lawsuit was filed in a federal district court in California by seven borrower defense applicants who represent, with certain exceptions, all borrowers with pending borrower defense applications filed on or before June 22, 2022. The lawsuit challenges the way ED has dealt with borrower defense applications in the past, including ED’s delays in issuing final decisions and ED’s denial of certain applications starting in December 2019. The case is now called Sweet v. Cardona, No. 3:19-cv-3674 (N.D. Cal.).”

By now, the loan had ballooned to over $100,000.

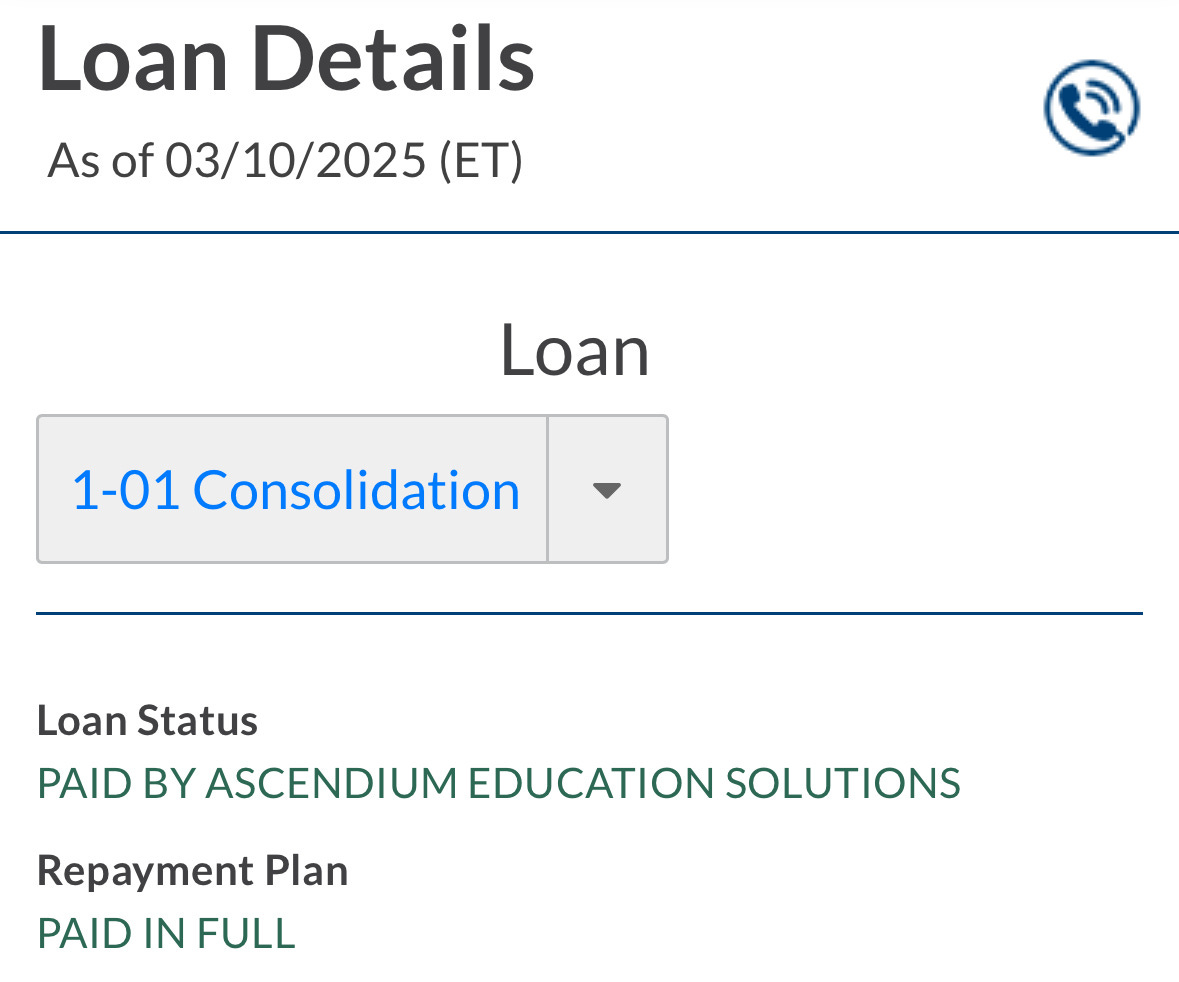

I waited. I watched the news. I wrung my hands a bit. I had my baby. After not hearing any updates in a while, I checked in with it today:

Thank you, Ascendium. I owe you a thank you note. And thank you to those seven borrower defense applicants who also knew the power of sticking up for yourself. I’m so grateful for their courage and determination.

For the first time for me in many, many years, the pot has been removed from the stove.

I know that, for many readers who’ve had to pay every cent of their student loans plus so much more, this is infuriating. And I get it. But I did try to pay the money I borrowed off, and they literally said no. They turned away good money; they gambled and they lost.

It’s not too late for you to file your own Borrower Defense. In fact, I highly recommend it — most colleges are one form of scam or another, and you never know what will happen if you give it a try. Think about all the money you’ll free up to tour, work on comedy, write, travel, and who knows what else. Go back to school? :-) I hope this changes the way that colleges operate from now on.

Side win: from this, and other experiences over the years, I’ve learned there’s almost no problem I can’t figure out. I also have learned that sticking up for yourself is always, always worth it. Let me help you solve a big problem. Try me. You have nothing to lose, except your problem.

Save your money—you might need it one day,

Daily Musings:

Borrower Defense | StudentAid

Sweet v. Cardona | PPSL

Neal Brennan on Student Debt | Netflix

This is beyond perfect - Don’t Pay Your Student Loans | CH

Wow, this brings up a lot of different thoughts and feelings for me. Years ago, when I was a young attorney, a group of young adults came to me wanting to sue a local private college for something similar--the program they wanted was full so a recruiter convinced each of them to do a different program and switch later, and for various reasons, they were never able to switch, and they all had student loans--I think around $20,000 each--for something that ended up being a waste of their time. While I had some legal theories about why the school owed them a refund, I didn't know anyone who had taken a case like that before, and I felt lost and unsure of what I was doing. My colleagues didn't seem to think it was a great case. I felt a huge obligation to them but constantly put their case off for other cases that were more urgent. After five years, we finally settled, and the school refunded most of their tuition. I hated taking a third of that as my fee, but it ended up being much less than my normal hourly rate for all the time I'd put in. Years later I started hearing about cases like this in the news. It was validating because it meant I was right about about a lot of things. But it also made me wonder if there was something more I could've done for them. I didn't know about the borrower defense (my case started pre-Google and the statute is not something that would have come up in typical legal research). I'm glad you were able to solve this problem yourself. Good for you!

Holy crap, so cool to hear a story from someone I know whose benefited from this. So happy for you, Jessica!!!